Free House Valuation Guide: Understand Your Home’s Real Worth in 2025

Your home is one of the most valuable assets you own. Whether you are thinking of selling, refinancing, or just curious about how your investment has grown, knowing its value is essential. A free house valuation gives you an easy and cost-free way to get a good idea of your home’s current market value.

This valuation helps you understand where your property stands in today’s market and allows you to make better decisions. If you plan to sell, you’ll know what price range to expect. If you want to refinance, you’ll know how much equity you have available. Even if you just want to track your property’s growth over time, having an updated valuation helps you stay informed.

Without a valuation, you might overprice or underprice your home, leading to delays, lost money, or missed opportunities. A free house valuation is therefore not just convenient, it’s a smart step toward financial clarity.

What Is a Free House Valuation?

A free house valuation is an online service that estimates how much your home is worth in the current market. These valuations use automated systems called AVMs (Automated Valuation Models) that gather data from public property records, recent sales in your neighborhood, tax information, and general market trends.

You simply enter details about your home, like its location, number of bedrooms and bathrooms, and any renovations you’ve made, and the system produces an estimated value within seconds.

It’s important to note that a free valuation is not the same as a professional appraisal. A licensed appraiser visits your property, examines its condition, and provides a certified report that banks and lenders use for official purposes. Free valuations, on the other hand, provide a quick estimate for your personal understanding or planning.

How Free Valuation Tools Work

Data and Algorithms Behind the Estimate

Free house valuation tools rely on powerful algorithms and data analysis. These systems pull data from local property databases, sales records, and neighborhood trends to calculate an estimated market price.

The model compares your home with similar properties that have recently sold—often called “comparables” or “comps.” It looks at square footage, location, property age, features, and recent upgrades. Based on these variables, it predicts your home’s current value range.

For example, if several homes near yours sold in the last three months for around $500,000, and your home has similar characteristics, the model will estimate your value close to that range.

This process happens almost instantly because the system automatically runs calculations across massive datasets.

What Information Do You Need to Provide

When using a free house valuation tool, you’ll typically need to provide:

- Your property address

- Property type (house, townhouse, apartment, etc.)

- Number of bedrooms and bathrooms

- Approximate square footage

- Notable upgrades (such as a new kitchen or roof)

Once entered, the tool will analyze comparable data and generate an estimated market value or range. Some tools even show nearby recent sales or price trends in your area, helping you understand how your property compares to others.

Benefits of Getting a Free House Valuation

It’s Fast and Free

The most obvious benefit is that it costs nothing. You don’t need to pay hundreds of dollars or wait several days for an official report. In just a few minutes, you can have a clear picture of your property’s estimated worth.

This is perfect if you’re still in the “thinking stage”—considering selling or refinancing—but not yet ready to commit to professional services.

It Helps You Make Smarter Decisions

With a free valuation, you can decide whether now is the right time to sell or refinance. If your home’s value has increased significantly, selling might bring you higher returns. If it’s lower than expected, you can hold off until the market improves or invest in home upgrades to raise its value.

Knowing your home’s estimated worth also helps you understand your equity position and whether refinancing or taking a home loan makes sense.

You Gain Negotiation Power

Having a value estimate gives you more confidence during negotiations. Whether you’re dealing with a buyer or a lender, you can refer to data rather than relying on opinions. This makes discussions more objective and less emotional.

You Can Track Value Growth Over Time

Free valuations let you monitor how your property’s value changes over months or years. Many tools allow you to check your home’s worth as often as you want. If the price rises steadily, you’ll know your investment is growing. If it drops, you can investigate why and plan accordingly.

You Avoid Pricing Mistakes

Overpricing your property can scare away potential buyers, while underpricing can cost you money. A free valuation gives you a reasonable price range to start from, helping you avoid common mistakes when listing your home.

Real-World Examples of Free House Valuation Tools

Below are five popular free valuation tools that homeowners often use to estimate their property value. These examples help you understand what features to look for and how to use them effectively.

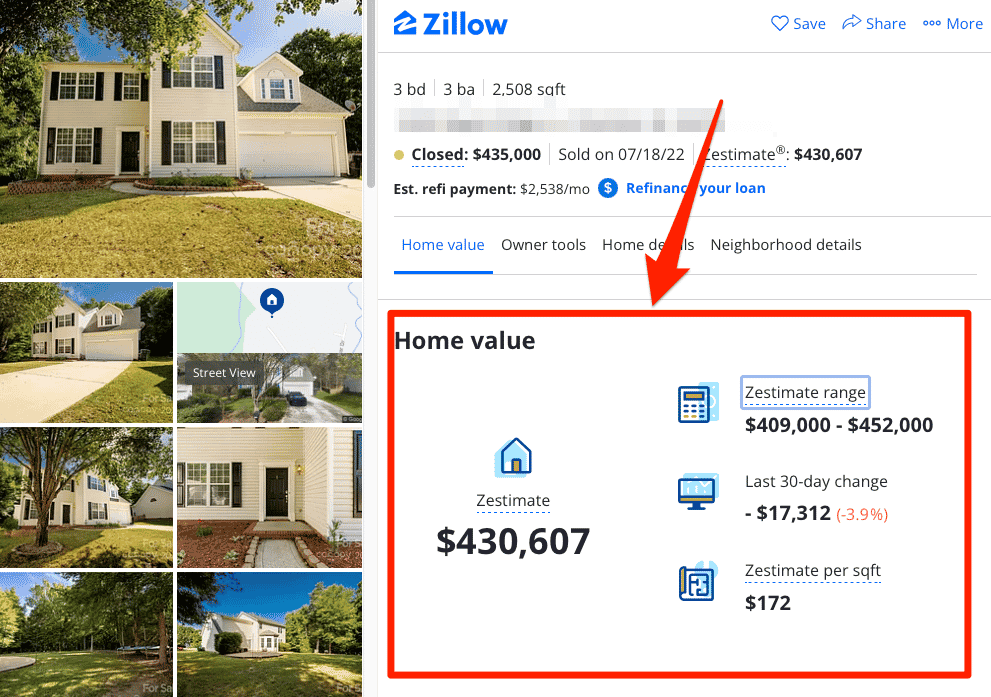

1. Zillow Free Home Value Estimator

Description:

Zillow offers a widely used tool called the “Zestimate,” which provides an estimated market value for your home. It uses millions of data points from property sales, market trends, and user-submitted updates.

Use Case:

If you’re thinking of selling your home soon, Zillow’s estimator helps you understand what similar homes in your neighborhood are selling for.

Benefits:

- Quick, free, and easy to use

- Provides a reliable starting point

- Helps you compare with similar nearby properties

Where to Access:

You can find the tool directly on Zillow’s website under the “How much is my home worth?” section.

2. Redfin Home Value Estimator

Description:

Redfin’s valuation tool analyzes multiple data points from recent property sales, neighborhood trends, and public records to deliver a near-instant estimate. It’s known for its strong accuracy in major metro areas.

Use Case:

Ideal for homeowners who want to compare estimates from more than one source or who need to understand their area’s market trends.

Benefits:

- Offers an up-to-date market overview

- Shows recent local sales

- Gives both value estimates and neighborhood context

Where to Access:

The estimator is available on Redfin’s main website under the “What is my home worth?” section.

3. PennyMac Home Value Estimator

Description:

PennyMac offers a free valuation tool specifically designed for homeowners considering refinancing. It provides estimated home value, price per square foot, and nearby comparable sales.

Use Case:

Best for those planning to refinance their mortgage or explore home equity options.

Benefits:

- Ideal for mortgage and financing decisions

- Provides a clear breakdown of comparable homes

- Free and easy to use

Where to Access:

Available on the PennyMac official site in their “Home Value Estimator” section.

4. Bank of America Home Value Tool

Description:

This tool gives a free, instant home value estimate backed by a trusted financial institution. It also provides nearby comparable sales and general market trend data.

Use Case:

Perfect for homeowners who want a valuation from a well-known bank or plan to discuss refinancing with their lender.

Benefits:

- Reliable brand

- Fast results

- Simple to use for both buyers and existing homeowners

Where to Access:

The tool is available through Bank of America’s real estate resource center online.

5. PropSeller Free Property Valuation

Description:

PropSeller offers a free, data-driven property value report. It uses recent market transactions and provides an analysis of comparable properties in your neighborhood.

Use Case:

Useful for homeowners who want a more detailed property report, including trend charts and expert consultation.

Benefits:

- Comprehensive free valuation

- Offers optional expert advice

- Great for sellers wanting extra insight

Where to Access:

You can use it directly through the PropSeller valuation page.

How to Choose the Right Free Valuation Tool

Identify Your Purpose

Before using a valuation tool, clarify your reason. If you’re preparing to sell, choose a platform that focuses on nearby recent sales and trends. If refinancing, select one connected to banks or mortgage services.

Compare Multiple Tools

Each platform uses slightly different data and models, so comparing two or more estimates gives a more accurate picture. If one tool shows a much higher or lower value than the others, that’s a sign to look deeper into recent market changes.

Consider Your Property’s Uniqueness

If your home has unique features—like a custom build, large lot, or luxury design—online estimators may struggle to price it accurately. In such cases, a local real estate agent or professional appraisal might be needed to confirm the online estimate.

Use the Data as a Starting Point

Treat these free valuations as informative guides, not final numbers. They provide context and direction, but your home’s actual selling price depends on buyer interest, condition, and timing.

How to Get the Most from Your Free Valuation

Gather Accurate Information

Make sure all details you enter—bedroom count, lot size, recent renovations—are accurate. Missing or incorrect data can affect your results.

Review Comparable Homes

Look at the list of comparable homes included in the estimate. Are they similar in condition and size to yours? If not, make mental adjustments to the valuation.

Understand Value Range

Most tools show a range (for example, $480,000 to $520,000) instead of one fixed number. That’s because real estate prices naturally fluctuate depending on buyer demand, season, and home condition.

Plan Your Next Step

If the estimated value is higher than expected, it might be a good time to sell or refinance. If it’s lower, focus on improvements that could raise your property’s worth, like updating kitchens or bathrooms.

Beyond Free Valuations: Next Steps

A free valuation is just the beginning. If you need a more precise estimate, consider these additional steps:

- Comparative Market Analysis (CMA): Conducted by a local real estate agent, this report offers deeper insight into your home’s market position.

- Professional Appraisal: A certified appraiser provides an official report used by lenders for mortgage and refinancing decisions.

- Home Improvement Evaluation: Identify which upgrades will offer the best return on investment before listing your home.

- Market Monitoring: Keep tracking your home’s value over time to decide when the market conditions are most favorable.

Common Problems Solved by Free Valuations

- Uncertainty About When to Sell

Free valuations help you decide if the market conditions are right to sell or wait. - Confusion Over Home Equity

Knowing your estimated value helps you calculate how much equity you have and whether refinancing is a smart move. - Overpricing or Underpricing

Many homeowners make costly mistakes by setting unrealistic prices. A free valuation offers data-based guidance. - Unclear Financial Planning

A clear idea of your home’s worth allows you to plan retirement, investments, or property upgrades confidently. - Tracking Investment Performance

Monitoring your property’s value helps you measure long-term growth and assess future opportunities.

How to Buy, Sell, or Use These Tools

Using free valuation tools doesn’t require any payment or commitment. Simply:

- Visit the website of the valuation service you prefer.

- Enter your property details accurately.

- Wait for the tool to generate your estimated home value.

- Save or download your results for comparison.

If you decide to sell or refinance after reviewing the estimate, most tools provide options to connect with real estate agents or mortgage consultants directly through their platform.

Final Thoughts

A free house valuation is one of the easiest and most valuable tools available for homeowners. It’s quick, costs nothing, and provides a data-driven estimate of what your property might be worth.

By using well-known tools like Zillow, Redfin, PennyMac, Bank of America, and PropSeller, you can get a comprehensive understanding of your home’s value and use that information to make smarter financial decisions.

When used wisely, these free valuations give you confidence—whether you’re preparing to sell, refinance, or simply monitor your investment. Understanding your home’s true worth is the first step toward making informed choices about your financial future.

Frequently Asked Questions

1. How accurate are free home valuations?

Free valuations are fairly accurate for giving a general idea of your home’s market range, but they can’t account for unique features or conditions inside the property. Use them as a starting point, not a final price.

2. Can I rely only on free valuations to set my selling price?

It’s better to combine online valuations with professional advice. A real estate agent’s comparative market analysis or a certified appraisal will give you a more precise number.

3. How often should I check my home’s value?

Check at least once a year, or more frequently if you’re planning to sell soon or if the real estate market changes rapidly in your area.