How to Evaluate Your House: A Simple Step-by-Step Guide to Knowing Your Home’s True Value

Evaluating your house means understanding how much your property is really worth in today’s market. This process is not only useful when selling your home—it’s also important for refinancing, borrowing, insurance, and long-term financial planning.

When you know your home’s value, you can make confident decisions instead of guessing. You’ll know whether your property has increased in value, whether you’re in a good position to sell, or whether it’s better to wait for market improvement. Home evaluation is the foundation for every smart homeowner’s decision.

What “Evaluating Your House” Really Means

To evaluate your house means finding out its fair market value—the amount a willing buyer would pay a willing seller under normal conditions. This value depends on many factors: location, size, layout, age, condition, nearby sales, and market demand.

In the past, people had to hire professional appraisers to get an accurate estimate. Today, technology makes this process much easier. You can use free online calculators or property platforms to get an instant idea of your home’s value. However, these online results are only estimates. A full evaluation combines both data-driven tools and local expert insight.

Key Factors That Influence Home Value

Several factors determine what your home is worth. Understanding them helps you interpret your valuation report more effectively.

1. Location

Location remains the strongest factor in property value. Homes in desirable neighborhoods—close to schools, business centers, shopping, or parks—usually have higher values. Proximity to highways or scenic views also adds value.

2. Size and Layout

Square footage, number of bedrooms and bathrooms, and layout efficiency all impact price. Larger homes generally command higher prices, but functionality and flow also matter.

3. Condition and Age

A newer or recently renovated house will have a higher value than one requiring repairs. Structural integrity, roofing, flooring, and updated systems (like plumbing and electricity) significantly affect valuation.

4. Market Trends

Housing demand and supply play a big role. During strong markets, home prices rise quickly; in slower markets, prices may drop or stabilize.

5. Comparable Sales

Real estate professionals often compare your home to recent sales of similar properties in your area—known as “comps.” This comparison helps estimate the realistic market value.

Step-by-Step Process to Evaluate Your House

Gather Key Property Information

Before using any valuation tool or contacting an expert, collect basic information about your property:

- Total square footage

- Number of bedrooms and bathrooms

- Lot size

- Year built and any renovations

- Special features (pool, garage, garden, smart systems)

Having this data ready ensures you get the most accurate results when using any tool.

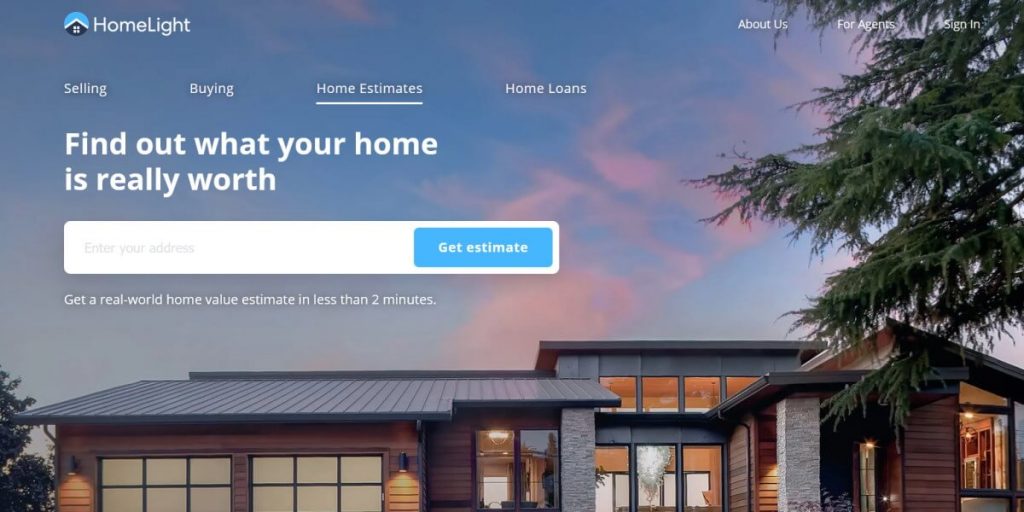

Use Online Home Value Estimators

Several online platforms allow homeowners to estimate property value by entering an address. These tools use Automated Valuation Models (AVMs) that analyze public records, sales data, and algorithms to create a price range.

While the estimate is not exact, it’s an excellent starting point. You’ll get a clear overview of where your property stands relative to others nearby.

Review Local Comparable Sales

Once you get an online estimate, look for nearby homes that recently sold. Try to find houses with similar features and location. Compare their sale prices to your estimate. This helps confirm if your valuation aligns with local market realities.

Consult a Local Real Estate Agent

Real estate agents have access to the Multiple Listing Service (MLS) and understand your neighborhood’s specific trends. They can perform a Comparative Market Analysis (CMA) to provide a more accurate number than an online calculator.

Hire a Professional Appraiser (Optional)

For the most accurate evaluation—especially before refinancing or selling—hire a certified appraiser. They visit your property in person, inspect its condition, and issue an official report accepted by banks and financial institutions.

Benefits of Evaluating Your House

Helps You Price Correctly When Selling

Setting the right price is critical. If you list too high, your home may sit on the market for months. Too low, and you lose potential profit. Evaluation ensures your price matches market expectations.

Gives Financial Clarity

Your home is often your largest asset. Knowing its value helps you plan your finances—whether you’re considering a second mortgage, investing in upgrades, or simply tracking your wealth growth.

Guides Renovation Decisions

A home evaluation can reveal areas where improvements might boost value. For example, updating the kitchen or adding outdoor space can increase your home’s appeal and resale price.

Strengthens Negotiation Power

When you know your home’s true value, you can negotiate confidently with buyers, banks, or contractors. You’ll be less likely to accept an offer that undervalues your property.

Prevents Future Surprises

Markets can change rapidly. By evaluating your house regularly, you can monitor value changes and adjust your financial plans accordingly.

Real-World Tools to Evaluate Your House

Here are five reliable examples of tools and services commonly used to estimate home value. Each one provides a unique approach and different types of reports.

1. PennyMac Home Value Estimator

This free online estimator allows homeowners to input their address and receive a detailed report. It includes property specifics, historical sales data, and value comparisons.

Use case: Ideal for homeowners exploring refinancing or wanting a quick overview of their property’s current worth.

Benefit: Simple to use, backed by a mortgage company, and suitable for quick financial planning.

Buying information: You can access it through the lender’s website and get results in minutes.

2. Redfin Home Value Estimator

Redfin’s estimator uses hundreds of data points from property records, market trends, and neighborhood analysis to estimate home values.

Use case: Best for homeowners who want a second opinion or broader insight into local market activity.

Benefit: Fast, user-friendly, and offers a side-by-side comparison with nearby properties.

Buying information: Accessible on the Redfin homepage with simple address input.

3. Realtor.com Value Estimator

This tool provides homeowners with an estimated value along with a trend graph showing how their home’s price may have changed over time.

Use case: Great for sellers tracking value growth and timing the market before listing.

Benefit: Offers useful data about market direction, helping owners plan strategically.

Buying information: Free to use; results available instantly online.

4. Bank of America Home Value Tool

Provided by a well-known financial institution, this estimator gives a quick valuation based on public data.

Use case: Helpful for homeowners considering mortgage refinancing or home equity loans.

Benefit: Trusted source and integrated with other banking tools for financial decision-making.

Buying information: Available through the bank’s real estate section.

5. Stewart Valuation Service

This service provides a downloadable, detailed valuation report including local sales, property features, and a market overview.

Use case: Suitable for investors or sellers who want a deeper look beyond a simple online calculator.

Benefit: Detailed and professional-grade report for strategic planning.

Buying information: The estimator is free to use and delivers comprehensive results.

How to Use Your House Evaluation Effectively

If You Plan to Sell

Use the valuation to decide your listing price and selling strategy. If the value is lower than expected, consider improving curb appeal or making updates before listing. When pricing your home, balance realism with competitiveness to attract buyers quickly.

If You Plan to Refinance

Home evaluation determines your equity—the difference between your home’s value and your mortgage balance. A higher value can help you qualify for better loan terms or lower interest rates. It’s essential to have an updated valuation before applying for refinancing.

For Long-Term Investment Tracking

Even if you don’t plan to sell, evaluating your home annually helps track your property’s performance as an investment. It shows appreciation trends and alerts you if the market declines.

For Renovation Planning

Your evaluation can highlight which improvements could raise your property value the most. For example, if similar nearby homes with upgraded kitchens are valued higher, that renovation may bring strong returns.

Common Mistakes Homeowners Make When Evaluating Their House

Ignoring Home Condition

Many people assume their property’s value equals that of a similar-sized home nearby. However, outdated interiors, deferred maintenance, or worn-out features can reduce value significantly.

Overestimating Market Strength

During hot markets, sellers often overprice their homes. A realistic evaluation prevents this by grounding expectations in data rather than emotion.

Relying Only on Online Tools

Online estimators provide convenience but lack personal insight. For best results, combine them with local research or a professional opinion.

Forgetting to Update Information

If your property details (like renovations or expansions) aren’t updated in public records, your online valuation might be inaccurate. Always ensure your property information is current before using valuation tools.

How Often Should You Evaluate Your House?

Most experts recommend evaluating your house at least once a year. However, if you’re planning to sell or refinance soon, you should check it more frequently—every few months—especially in rapidly changing markets.

Regular evaluation also helps homeowners catch early signs of property value shifts. For example, if neighborhood prices start dropping, you might choose to sell sooner or hold off on upgrades until conditions improve.

How to Buy or Use Home Evaluation Tools

Most home evaluation tools are free and accessible online. Simply go to the company’s website, enter your home address, and review your estimate. If you need a more official report, you can purchase a professional appraisal through a certified appraiser or request a comparative market analysis from a real estate agent.

Some platforms also offer premium reports with deeper data for a small fee, which can be useful when preparing for major financial decisions like refinancing or investment.

Real-Life Problems Home Evaluation Solves

- Avoiding Pricing Errors: Without evaluation, sellers often overprice or underprice their homes. A solid valuation helps you set a competitive price.

- Managing Financial Risk: Knowing your home’s value protects you from borrowing too much or refinancing at the wrong time.

- Making Smart Renovations: Evaluation shows which upgrades matter most to buyers and add real value.

- Tracking Investment Growth: Your home is part of your financial portfolio. Regular evaluation helps you measure how it’s performing.

- Improving Negotiation Power: Whether dealing with buyers or lenders, knowing your true value keeps you in control.

Frequently Asked Questions

1. Are online home value calculators accurate?

Online estimators provide a general idea but may miss unique property details. They are useful for starting your research, but not precise enough for official purposes like refinancing or legal transactions.

2. How can I increase my home’s value before evaluation?

Focus on upgrades that buyers care about most—such as kitchens, bathrooms, and outdoor spaces. Ensure the home is well-maintained, freshly painted, and clean to make a strong impression.

3. Should I get a professional appraisal even if I already used an online tool?

Yes, if you’re selling or refinancing, a professional appraisal provides a verified, unbiased valuation accepted by lenders and buyers. Online tools are best for quick checks, not final decisions.

Conclusion

Evaluating your house isn’t just about knowing a number—it’s about understanding your property’s true potential and using that knowledge to make smart financial moves. Whether you’re preparing to sell, refinance, or plan long-term investments, an accurate home evaluation gives you control and confidence.

By combining free online tools, market research, and expert advice, you’ll have a realistic picture of your property’s worth. The key is to update this evaluation regularly, stay informed about market changes, and use the information strategically.