Discover Your Free Home Value: How to Estimate Your Property Worth Easily

When it comes to buying, selling, or refinancing, knowing your home’s current market value can make all the difference. Thanks to modern technology, you no longer need to hire an expensive appraiser just to get a general idea. Today, many reliable online tools allow you to estimate your home value for free within minutes.

This guide will explain what free home value tools are, how they work, their major benefits, and how to use them effectively. We’ll also review five real-world examples of well-known free valuation services and discuss why understanding your property’s value can help you make smarter financial decisions.

Understanding the Concept of Free Home Value

A free home value estimator is a tool that helps you understand what your property might be worth in the current market without paying any fee. These tools use recent sales data, public records, and smart algorithms to estimate the value of your home.

The concept is simple: by entering your home’s address and a few basic details—like the number of bedrooms, bathrooms, and total area—you can get a quick estimate of its potential selling price. These online estimators are built on something called Automated Valuation Models (AVMs). They analyze thousands of data points, such as:

- Comparable home sales in your neighborhood

- Property tax assessments

- Market trends in your area

- Location and local amenities

AVMs use this data to calculate an estimated value range for your property. Although it’s not as precise as a professional appraisal, it gives you a strong baseline.

Why You Should Check Your Free Home Value Today

Property values change constantly due to shifts in the real estate market, interest rates, and local economic conditions. What your home was worth last year might be completely different today.

By getting a free home value estimate, you can:

- Stay informed: Understand how much equity you’ve built.

- Make better decisions: Decide whether it’s a good time to sell or refinance.

- Avoid surprises: Learn your market position before buyers or lenders do.

For example, if you’re planning to sell, knowing your estimated value can help you set a realistic asking price. If you’re considering refinancing, it helps you see if you have enough equity to qualify for a lower rate.

Simply put, knowing your home’s value gives you power—power to plan, negotiate, and make strategic financial decisions.

How Free Home Value Estimators Work

The Technology Behind Home Value Estimators

Modern home value estimators rely on technology that blends public data with predictive analytics. They compare your property to similar homes that have recently sold nearby, taking into account location, property size, condition, and amenities.

For example, if your neighbor’s home—similar in size and design—sold last month for a specific price, the algorithm might use that sale as a reference to calculate your home’s estimated worth. These algorithms constantly update as new data becomes available, ensuring your results reflect current market conditions.

What You Need to Provide

Most online estimators only need your home address to begin. Some may ask for additional details like:

- Total square footage

- Number of bedrooms and bathrooms

- Any upgrades or renovations

- Type of property (house, condo, townhouse, etc.)

Once submitted, the tool instantly displays a value range—often including a low and high estimate. Some even provide a confidence score or a list of comparable properties used in the calculation.

Benefits of Using Free Home Value Estimators

1. They’re Free and Instant

The biggest advantage is that these tools are completely free. You don’t need to hire anyone, schedule appointments, or wait for reports. Within minutes, you can have a value range ready to review. This is especially helpful if you need quick information for refinancing or considering a sale.

2. No Commitment Required

Free home valuation tools don’t require you to commit to selling your property. You can check your home’s value privately, anytime, without pressure from agents or lenders.

3. Data-Driven Insights

These tools rely on large datasets and machine learning models, which means they can process thousands of property comparisons in seconds. You get insights into how your home compares to others in your neighborhood.

4. Helps You Plan Strategically

Knowing your home’s estimated value helps with financial planning. You can use this information to decide whether to:

- Sell your property soon

- Invest in home improvements

- Refinance your mortgage

- Estimate property taxes or insurance adjustments

5. Great for Long-Term Monitoring

You can use these tools regularly—every few months—to track changes in your property value. Monitoring your home’s worth helps you understand appreciation trends and anticipate market shifts.

Five Real-World Examples of Free Home Value Tools

Here are five commonly used online tools that provide free home value estimates. Each offers unique features and levels of detail to help you better understand your property’s market value.

1. Zillow Home Value Estimator

Zillow’s estimator is one of the most popular online valuation tools in the real estate industry. It uses a system known as the “Zestimate,” which calculates your home’s worth using public data and recent home sales.

Key Features:

- Easy to use—just enter your address.

- Provides a value range and accuracy score.

- Updates regularly as market conditions change.

Use Case:

If you’re thinking about selling your home soon, Zillow’s estimate gives a solid baseline for setting your asking price.

Benefit:

It provides quick, reliable insight into your property’s worth and helps you compare your home with others nearby.

2. Redfin Estimate Tool

Redfin’s free estimator offers highly accurate results, especially for homes listed on the market. It analyzes hundreds of data points, including MLS (Multiple Listing Service) information.

Key Features:

- Instant home value estimate.

- Includes local market trends and comparison charts.

- Automatically adjusts when new sales occur nearby.

Use Case:

Ideal for homeowners who want deeper insight into market movement in their specific neighborhood.

Benefit:

It gives an understanding of your home’s competitiveness in the local market and helps identify the best time to sell.

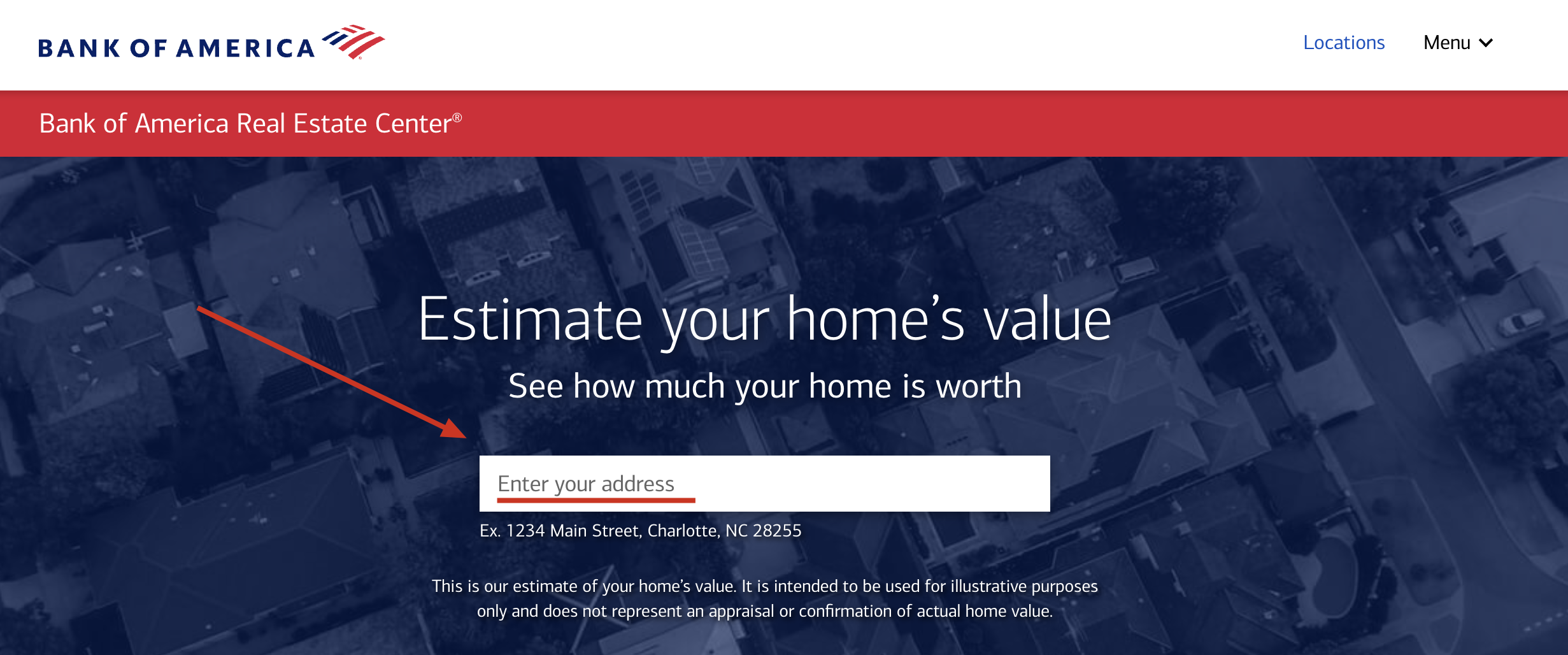

3. Bank of America Home Value Tool

This tool allows homeowners to get a free home value estimate through a trusted financial institution. It’s particularly useful if you’re planning to refinance or apply for a home equity loan.

Key Features:

- Instant valuation report.

- Integrated financial guidance for loans or refinancing.

- Secure and easy to use.

Use Case:

Great for homeowners who want both a valuation and advice on possible financial steps, such as refinancing.

Benefit:

Provides both property value and context for financial decision-making, all in one place.

4. Stewart Valuation Home Report

Stewart Valuation offers a more detailed approach to property estimates. Their reports include value history, comparable sales, and neighborhood data.

Key Features:

- Comprehensive reporta s in downloadable format.

- Historical data on price trends.

- Details on comparable home sales.

Use Case:

Perfect for homeowners who want a deeper analysis before deciding to sell or refinance.

Benefit:

You get more than a single number—you gain a full picture of how your home’s value evolved.

5. Guaranteed Rate Valuation Tool

This free valuation service focuses on homeowners exploring refinancing or cash-out options. It’s integrated with mortgage services for convenience.

Key Features:

- Fast results within seconds.

- Simple interface for entering property information.

- Designed for users considering mortgage adjustments.

Use Case:

Best for people interested in using home equity or refinancing their mortgage.

Benefit:

It provides not only a home value estimate but also helps you explore financial opportunities connected to your property.

How to Make the Most of a Free Home Value Estimate

Getting a free home value estimate is useful, but to maximize its accuracy and value, you should take a few smart steps.

1. Provide Accurate Details

When filling out the estimator form, ensure your property information is up to date. Include any recent upgrades or renovations, such as a new kitchen, roof, or flooring. Even small details can significantly affect your estimate.

2. Compare Multiple Estimates

Each tool uses different data sources and algorithms. It’s best to compare two or three estimates to get a more balanced understanding of your home’s value.

3. Analyze the Results

Look beyond the final number. Pay attention to the low and high value range, recent comparable sales, and market trends. This gives a clearer picture of your property’s true position in the market.

4. Consult a Local Expert

While online estimates are helpful, they can’t replace professional experience. If you’re planning to sell soon, consider talking with a local real estate agent or certified appraiser for more precise guidance.

5. Track Changes Over Time

Use free home valuation tools periodically—every few months—to monitor how your property’s value changes. This helps you make timely decisions if the market shifts or if you’re considering listing your home.

Challenges and Limitations of Free Home Value Tools

Even though these estimators are convenient, they’re not perfect. Here are a few limitations to keep in mind:

- Data Accuracy: Algorithms may not fully account for propertyconditionsn or recent renovations.

- Location Differences: Tools work best in urban areas where there’s plenty of comparable sales data.

- No Visual Inspection: Unlike professional appraisals, these estimators don’t physically inspect your home.

- Fluctuating Markets: Market volatility can quickly change value estimates.

Treat the results as an informative guideline, not an official valuation.

How Free Home Value Tools Solve Common Homeowner Problems

- Solving Uncertainty

Many homeowners simply don’t know how much their property is worth. Free valuation tools give you instant clarity and confidence. - Helping with Sale Preparation

Knowing your home’s estimated value helps you set realistic expectations and price your property competitively. - Supporting Refinancing Decisions

You’ll understand how much equity you have and whether it’s a good time to refinance or apply for a home equity loan. - Planning Home Improvements

If your home’s value seems lower than expected, you might identify areas where upgrades could boost its worth. - Monitoring Market Growth

By tracking your property value regularly, you’ll be ready to act when market conditions become favorable.

How to Use and Where to Access Free Home Value Tools

Most tools are available online and work directly through official websites or real estate platforms. Simply visit a trusted provider, enter your property details, and review the results.

Many websites also allow you to download your report or save it for future reference. If you’re using these tools to plan a sale or refinance, you can follow up directly with a real estate professional or financial advisor afterward.

Frequently Asked Questions (FAQ)

1. Are free home value estimates accurate?

They are fairly accurate for most properties, especially in areas with many recent sales. However, they may not fully account for unique home features or recent upgrades.

2. Do I need to pay to use a free home value tool?

No. These estimators are completely free and require no payment or commitment.

3. How often should I check my home’s value?

It’s recommended to check every 6–12 months or before major financial decisions like selling, refinancing, or taking out a home equity loan.

Final Thoughts

Knowing your free home value is one of the simplest yet most powerful steps you can take as a homeowner. These tools give you quick access to essential information about your property’s worth—without cost or hassle.

While they shouldn’t replace professional advice, they help you make smarter, data-driven decisions. Whether you plan to sell, refinance, invest, or simply track your home’s performance, understanding its value gives you confidence and control over your biggest asset.

Take a few minutes today to explore your free home value estimate—and gain a clearer picture of your home’s financial potential.